Last week I reviewed the workings of a balance sheet and showed you how you can use it to make better decisions for your business. This week, I would like to do a similar post about profit and loss statements. This will bring this series on charts of accounts and associated reports to a close.

What is a profit and loss statement?

The profit and loss statement (P&L) is a summary of how your business is performing over a particular period of time (monthly, quarterly or annually). It outlines your gross income less any cost of sales, less total expenses which result in your net profit or loss figure, hence the name. The P&L allows you to track how your business is going – the good and the bad.

What does a profit and loss statement look like?

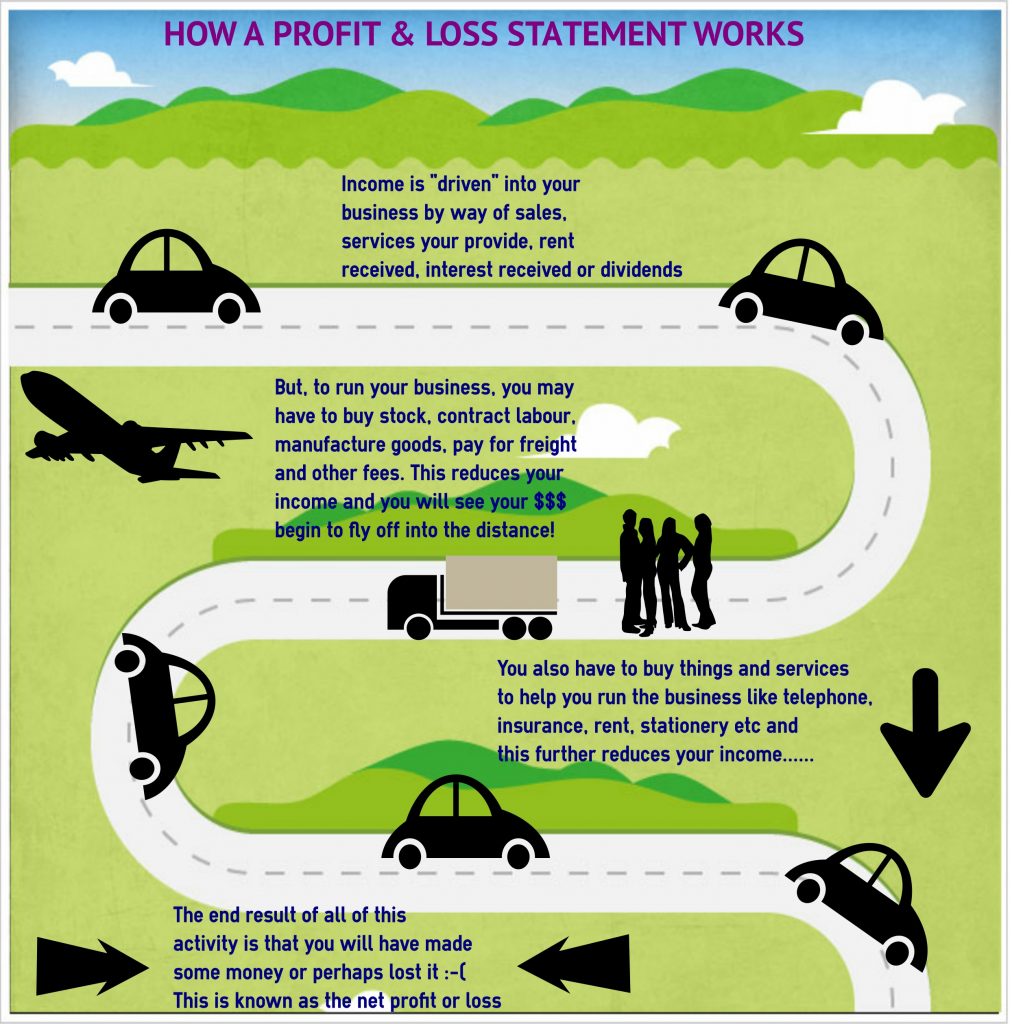

This infographic shows how a P&L works which should help to clarify any confusion you may have:

How can I use a profit and loss statement to help me in my business?

The P&L statement, much like the balance sheet, is a very useful tool for business owners. If you aren’t already, you should be reviewing one at least monthly so you can keep an eye on how your business is faring. If you don’t know how to access your P&L statement, ask your bookkeeper or accountant for assistance.

The P&L statement, as I said above, gives you insight into how your business is performing. It lets you see

- if you are making any money

- which income streams are more profitable than others

- the status of your cost of sales items – which ones are costing your business too much?

- where your business spends it money

- if your business is profitable or not

As the business owner, you can use this information to make informed decisions about for your business. Amongst others, you can decide

- to remove an income stream if it is no longer profitable

- to look for ways to improve those income streams that are doing well

- to assess your cost of sales items and remove those that are no longer needed and/or look for more cost effective alternatives

- to review your expenses and perhaps negotiate better deals with suppliers and/or remove those you no longer require

- to review your staffing – do you need more employees or less?

- to compare these “actual” results with your forecasted projection. From here you can begin to see why your business is succeeding or failing (but that’s a topic for another blog!)

A P&L statement can also be used to:

- help you provide proof of income if you are trying to get a loan

- assist the accountant to process your income tax return

- let you compare your performance against industry benchmarks

The P&L statement along with the balance sheet, allows you to really track the performance of your business accurately. Add to the mix cashflow forecasts and budgets, and you’re well on your way to taking control of your numbers! (I’ll cover cashflow forecasts and budgets down the track….). I believe if you have control of your numbers, you have control of your business (it’s our tagline!). This is imperative for the future success of your business. So get to it today – start reviewing your numbers!