Think you can get away with not paying your employees’ super? Think again!

Employers intentionally not paying their employees’ super has always been a bugbear of mine. If you follow my Twitter (X) account, you may have seen the hashtag I use: “#notyourmoney“. I use this hashtag because I believe that employee superannuation is not your money and never will be and I want to enforce this concept. These irresponsible employers anger me. It is completely wrong to hire people and then fail to fulfill the contract you agreed upon, which includes paying their super. In my opinion, not paying super is equivalent to stealing.

In the past, employers were able to get away with this unacceptable behavior because the Australian Taxation Office (ATO) only found out about it when employees reported them. At that point, the ATO would investigate, audit, and penalise these employers. This reactive approach has resulted in an estimated $2.5 billion shortfall in unpaid super. This is a truly disgraceful situation.

But things are about to change…

In the 2023-24 Federal Budget, it was announced that the ATO will receive $40.2 million for super compliance measures. This funding includes $27 million for data matching capabilities to identify and take action on cases of Superannuation Guarantee (SG) underpayment, as well as $13.2 million for consultation and co-design.

So what does this mean? Who/what will the ATO be data matching with?

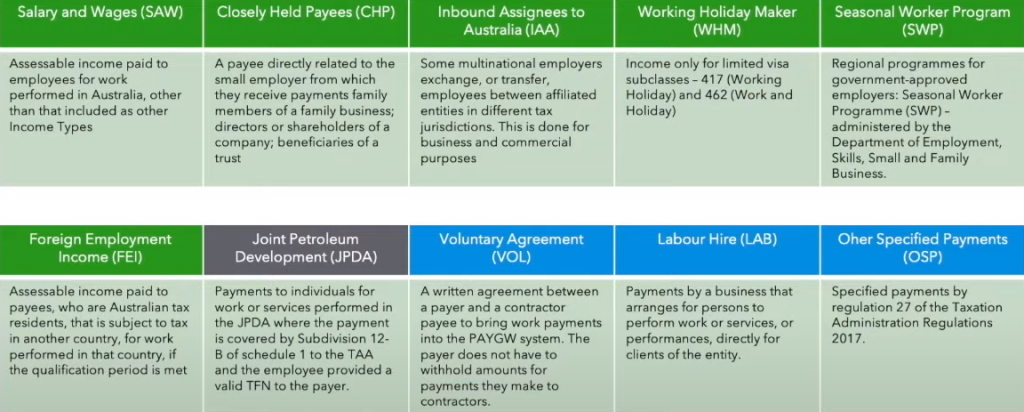

Firstly, it is now widely known that the ATO receives payroll data from employers through Single Touch Payroll events (STP). This data includes the superannuation amounts owed to employees’ super funds. The ATO also receives information about employees’ super from the Australian Prudential Regulation Authority (APRA) through the Member Account Transaction Service (MATS). MATS is a reporting service used for more frequent and detailed reporting of member super contributions and transactions. The ATO utilises the information from both sources to identify potential non-compliant behaviour by employers.

With increased funding from the budget, the ATO will intensify data-matching activities between STP and MATS. This shift from a reactive to a proactive approach means that the ATO will be able to initiate audits themselves instead of relying on employees to report non-compliance after the fact.

It is important to note that this data-matching activity is not new. It has been ongoing since 2019, with the ATO reporting a 24% increase in investigations of super non-compliance. What is new is the improved data matching capabilities enabled by better technology and more comprehensive STP data.

The ATO is now more focused than ever on addressing super non-compliance. They have the necessary tools and resources to conduct investigations and audits on a large scale.

This makes me feel more positive about this problem. I sincerely hope the ATO succeeds in its efforts. I have a strong aversion to employers who think they can evade paying super. It is essentially stealing, a white-collar crime. Thanks to the ATO’s real-time monitoring, the likelihood of getting away with non-payment of super is rapidly decreasing. And that is a very good thing!

Think you can get away with not paying your employees’ super? Think again! Read More »