How to Series No 2 – How to Enter VicRoads Registration Bills

Last week, I started a bookkeeping resource series called “How To”. Each week I will share instructions with you about how to enter some common transactions. I will be using Xero to present the example, but don’t worry if you use another software, the basic rules will still apply. Last week I explained how to enter an insurance bill.

The second how-to is about how to enter a VicRoads registration expense/bill into your accounts.

Step 1

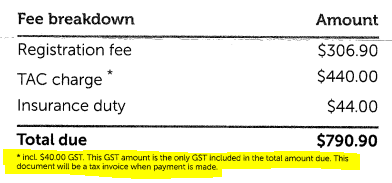

Grab your VicRoads bill and go to the part where it shows you the breakdown of charges. It may look something like this:

Step 2

Log into your software and go to the area where you enter bills.

Step 3

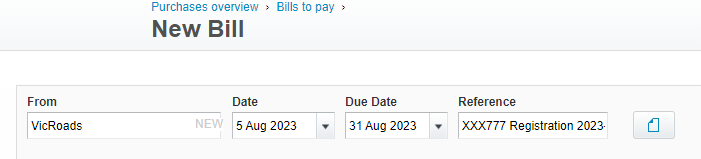

Enter the VicRoads as the supplier, the relevant dates and the reference number or name as below:

Step 4

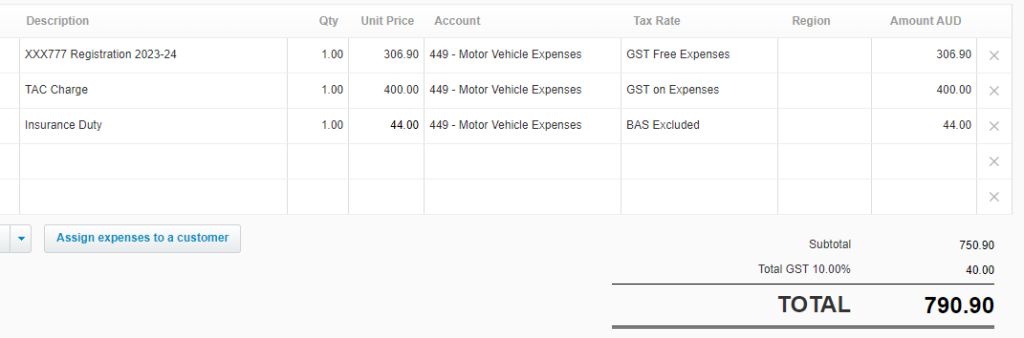

Enter a line in the bill for each charge shown on the bill. The registration fee is GST-free, the TAC charge includes GST and the insurance duty is BAS Excluded. If you are entitled to claim 100% of motor vehicle costs in your business, then you can claim the full GST amount on the TAC charge. Time and time again, I see clients entering the full amount of the registration expense as GST-free. While they are partly right, they are also missing out on claiming the GST of the TAC charge. Also, relevant here is the choice of account for expense coding – you may like a general account such as this one “Motor Vehicle Expenses”, or you may like to split your costs out in a more detailed manner and have an account for each type of car expense, in this case, “Motor Vehicle Registration”. It just depends on how much detail you want to see in your profit and loss report.

Step 5

Check that the GST amount agrees with the VicRoads bill. In this case, it is $40.00.

Step 6

Approve the bill to ensure the expense is added to the accounts correctly.

Final words…

So that’s it for this week’s “how-to”. I hope you learned something new. One thing I’d like to add about VicRoads “bills” before I close off this blog, is that to obtain an actual bill, you do have to have an account with VicRoads. They used to send out the document in the mail, but not anymore – it’s all online, like everything these days. Here’s the link to VicRoads where you can make an account if you haven’t already done so.

Bonus Tip!

For any bookkeepers out there who know the pain of not ever receiving an actual VicRoads bill from clients (who probably don’t know how to get it – see notes above), which makes data entry nearly impossible, here is the link to the TAC registration rates for FY24. This document provides the breakdown of TAC and insurance duty fees based on postcode and vehicle type. An excellent resource that I am sure you will use time and time again. There is also an online calculator you can use on the VicRoads website that will provide the figures you need easily. Here is the link for the calculator. Either resource will get you the information you need. You’re welcome by the way!

Next week I will show you how to enter a chattel mortgage loan. Until then, have a happy week.

How to Series No 2 – How to Enter VicRoads Registration Bills Read More »