New Accounting Software for Sole Traders

Recently, I have seen some new software players in the accounting software space. These developers have created software just for sole traders, freelancers and the self-employed. I think this is a great idea as some accounting software can be very overwhelming and complicated and contain many functions that sole operators just don’t require. This week I am reviewing 2 of these new software: Solo by MYOB and Sole.

Sole

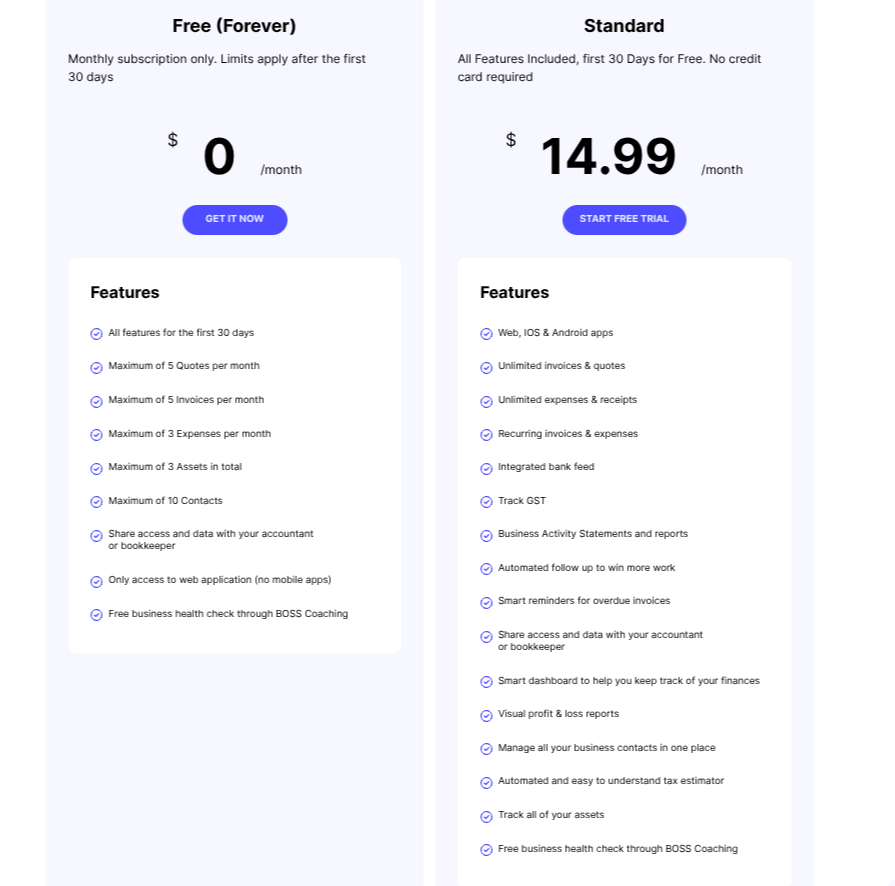

Sole is an Australian accounting software that offers GST tracking, expense categorisation, invoicing, quotes, bank feeds customer reminders, tax reporting tools and financial reporting. There is both a web and mobile app. The user can invite their tax professional to connect to the file if required. The cost is reasonable as can be seen below. There is also a free forever option, however the features are somewhat limited. Sole does not offer payroll but has partnered with Clockon to assist with Single Touch Payroll reporting. Sole is not suitable if your business has advanced inventory management needs, relies heavily on external CRM systems or requires integration with several other platforms.

Solo by MYOB

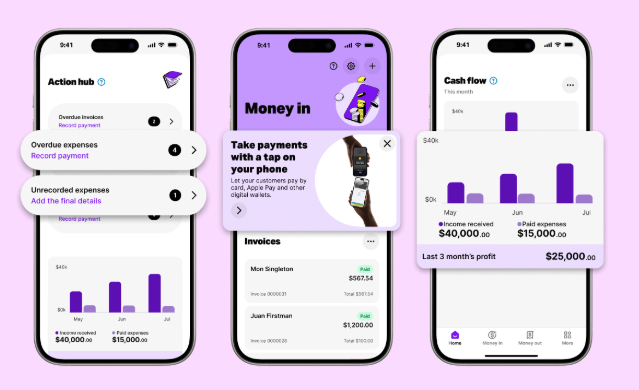

Solo is an MYOB product which launched in November 2024. It is a mobile app only, that is, it isn’t available on the web. Solo does not include payroll or inventory management. At the time of writing this blog, users cannot invite their tax professionals into the Sole file, however, reports can be downloaded and provided to bookkeepers etc. Solo is an app available on IOS and Android and offers expense tracking, record-keeping, tax and GST tracking, invoicing and in-person “Tap to Pay” payments, income snapshot reports and bank feeds. MYOB reports that more features will become available during 2025. The current price for Solo is $12 for 12 months and then $99 per year following the first year.

These two software tools could be very helpful for “solopreneurs”, especially startups. Any product that helps business owners get organized, manage record-keeping, and assist with reporting is valuable. While these tools are quite basic in functionality, they are a good starting point and help users understand bookkeeping and tax requirements. I believe these software tools will become very popular, and I’m sure more similar products will follow in their footsteps soon.

New Accounting Software for Sole Traders Read More »