8 ways you can give your BAS Agent authority to lodge your BAS (yes, there are 8!)

If you get your BAS or Tax Agent to lodge forms like the Business Activity Statement (BAS) or Instalment Activity Statement (IAS) and others, you

Welcome to our bookkeeping blog! We share bookkeeping tips, software updates and the latest news from the ATO. Sometimes we get a bit cheeky and let you know what we really think about this industry, but we try to behave ourselves most of the time! Enjoy the read and if you’re looking for anything in particular, hit the search button above.

If you get your BAS or Tax Agent to lodge forms like the Business Activity Statement (BAS) or Instalment Activity Statement (IAS) and others, you

BAS Agents are now a very important part of the tax compliance landscape. They have been floating around since 2010 when the first group of

Do you understand why record-keeping is so important (whether you’re in business or not)? No? Well here is your complete why what and how of

Employing staff can be a minefield even for the best of us! One of the confusing aspects can be understanding the difference between employment statuses

So the BAS lodgement date came and went and you didn’t get around to lodging your BAS – what happens now? The Australian Tax Office

Data entry into your accounting software is a menial and thankless task but one that most of us have to do on a regular basis

Are you a new employer? Do you need help with getting started? Do you know what your employer obligations involve? Being an employer is a

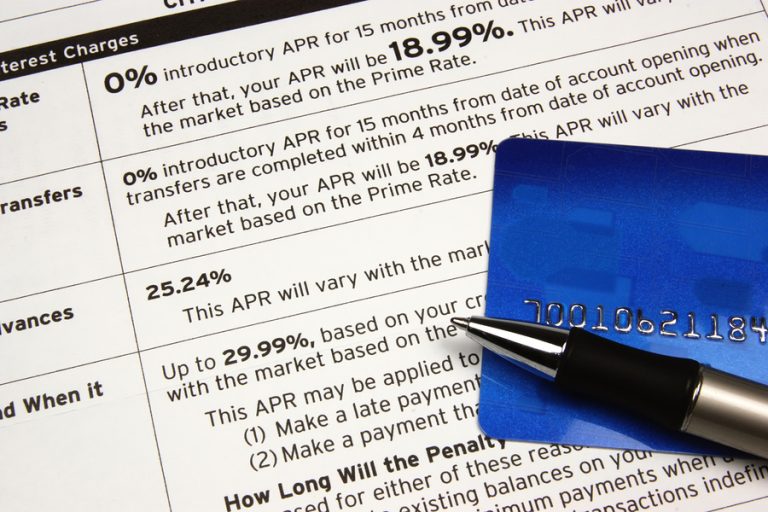

Even though the Goods and Services Tax (GST) has been in operation for more than 20 years, despite its best efforts to educate the general

It’s a well known fact that almost everyone can prepare and lodge the Business Activity Statement (BAS). Those who charge a fee for this task