Free Courses for Small Business from the ATO

The ATO has set up a website to help small business owners learn about running their businesses. It’s called Essentials to Strengthen your Small Business.

Welcome to our bookkeeping blog! We share bookkeeping tips, software updates and the latest news from the ATO. Sometimes we get a bit cheeky and let you know what we really think about this industry, but we try to behave ourselves most of the time! Enjoy the read and if you’re looking for anything in particular, hit the search button above.

The ATO has set up a website to help small business owners learn about running their businesses. It’s called Essentials to Strengthen your Small Business.

Cannot link to your new tax agent? The problem may be outdated ABN Details.

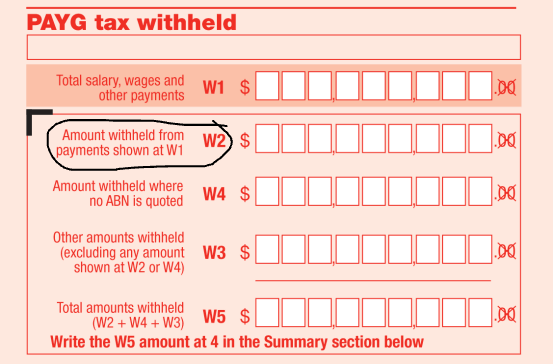

If you’re an employer, your PAYG withholding (PAYGWH) cycle might change depending on how much you withheld in the prior financial year.

In this blog, I will share some useful links, videos and phone numbers to help those stumbling through the Client Agent Linking process.

Wage Theft Legislation will make it a criminal offence to underpay wages deliberately.

since its live delivery, both agents and clients alike are finding that from a practical perspective, CAL is less than perfect!

The intended outcome of this new process is to reduce fraud and identity theft and improve data security.

There are 3 Fair Work Information Statements. Which one do you give to your employees? One or all three?

The fourth how-to is about how to account for hire purchases in your accounting software.