Transitioning to STP Phase 2 – Planning Ahead

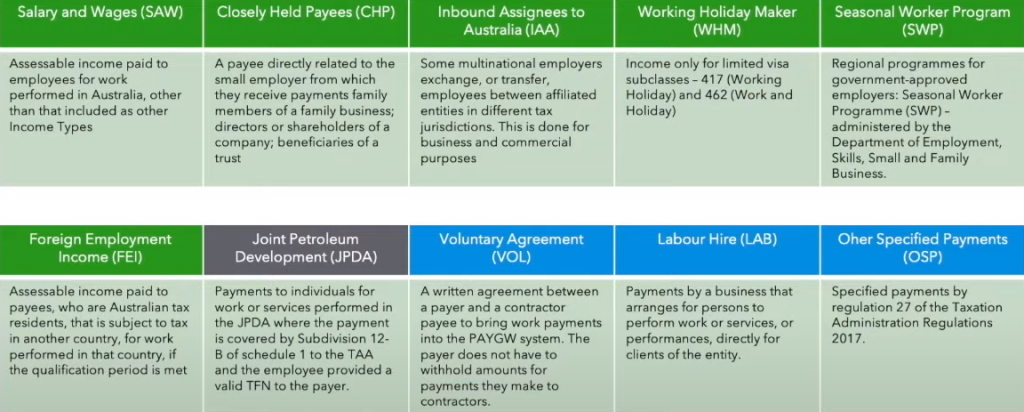

This is the final blog in a four-part blog series about STP Phase 2. In part one of this blog series, we looked at the benefits of phase 2, then, in part two, we outlined which software providers are ready for STP 2 now. Part three in the series delved deeper into the technical side of STP Phase 2. This final blog will focus on the sorts of things employers or their bookkeepers can do now, in order to plan ahead for a smooth transition to STP Phase 2.

STP Phase 2 will require employers and/or bookkeepers to firstly understand how it will change payroll, and secondly, the specific changes they need to make to their own payroll. It can be overwhelming and confusing, to say the least! The main thing to remember is that your payroll provider will do most of the heavy lifting in terms of creating the infrastructure needed to facilitate STP 2. Your job is to understand the terminology and how the new reporting requirements apply to your payroll setup and your employees/payees. This may take some time, and thankfully, time is on your side, given the ATO has provided a blanket deferral until 1st March 2022. Also, several payroll providers have attained a much longer deferral which also covers their customers.

The best thing you can do is to start to review your current payroll setup. Check employees’ details both personal and payroll-related. I have created a spreadsheet you can use to review your current employees/payees which you can download and use as needed (see below). This spreadsheet will collate most of the information you will need in order to transition to STP 2. Start the process by completing the spreadsheet and then, when you are ready to transition, you will have most of the required information at your fingertips.

Next, sit down with your employees/payees and explain what will happen once STP 2 begins. Tell them about how their information will be shared with the ATO and Services Australia. Explain that their payslips and income statements will look different and why. You may need to ask payees for more personal information during the setup of STP 2 – try to get ahead of the game and find out what sorts of data you don’t have and work with your payees to obtain it.

Keep an eye on your payroll provider’s pathway to STP 2. Your provider will advise you when you can transition and how it is to be done within the software itself. This may not happen for some months, but you can still prepare as per my above tips!

Lastly, think about when you would like to transition to STP 2. Yes, there are time constraints as per the ATO but they do say you can move over at any time during the year (provided you are covered by a deferral). However, you may like to put a plan in place and decide on a cutover date. That way, you can work towards the move to STP 2 in a timely manner and in a fashion that works for you and your business.

Lastly, to help you with your STP 2 plan and research, the ATO has created a set of guidelines for employers (see below). Download it and pop it away for use when you are ready to transition (or start your research now). Remember, don’t panic! There’s plenty of time and there will be a lot of help available to you when the time comes to tackle STP Phase 2!

Transitioning to STP Phase 2 – Planning Ahead Read More »