How to account for prepayments and GST

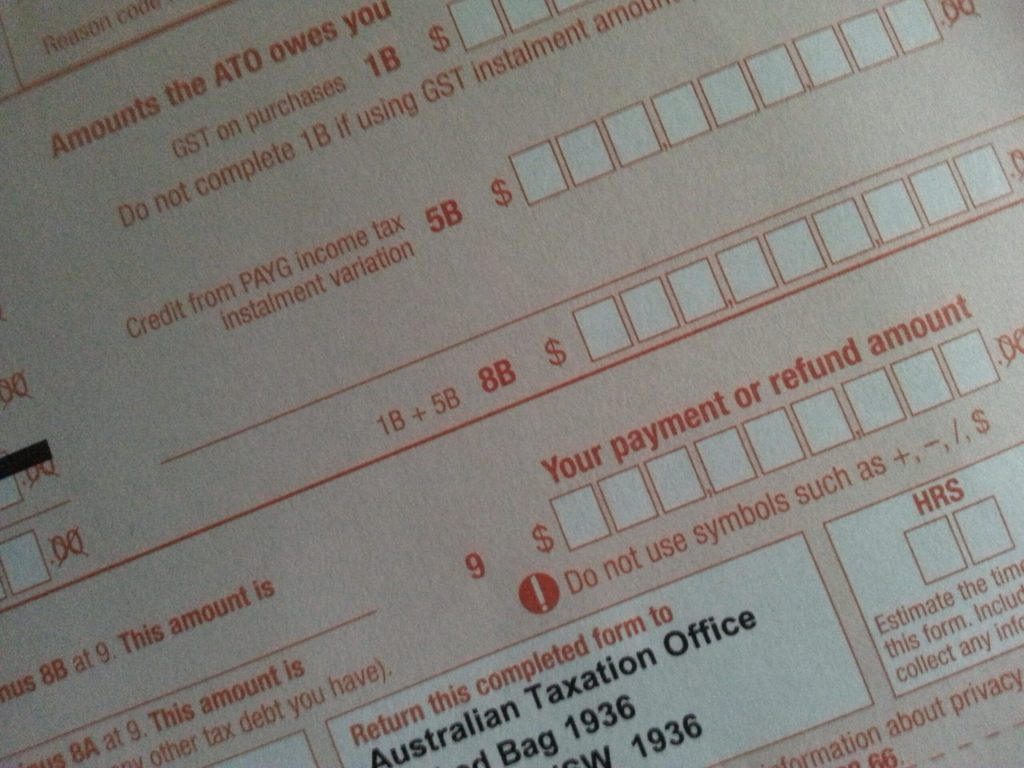

Towards the end of each financial year, many business owners review their expenses and pinpoint which ones can be prepaid before June 30 in order to obtain a substantial tax deduction. Typically, expenses such as office rent and insurance are paid 12 months in advance and are then classified as prepayments. This is particularly useful if the profit margin is high and the business owner wishes to reduce tax payable (and who doesn’t!). But how do you enter these transactions into your accounts and how is GST affected? Let’s review this now.

…

How to account for prepayments and GST Read More »