Bookkeeping vs BAS Services: Why the Difference Matters

Many businesses engage the services of professional bookkeepers, either as contractors or employees. These workers are involved in various aspects of a business’ operations, including sales, purchases, bank reconciliation, payroll and much more. But did you know that some services a bookkeeper provides are known as “BAS services” and some are basic bookkeeping services? There is a difference! In short, basic bookkeeping tasks and BAS services are not the same thing. Why is this important and why should business owners understand this concept? Read on to find out and to obtain a free bonus list of BAS services for your future reference.

Difference between bookkeeping and BAS services (and why it matters)

The Tax Practitioners Board (TPB) has a clear distinction between basic bookkeeping tasks and BAS services. They’ve made this distinction for a crucial reason: to ensure that only registered BAS agents perform BAS services for a fee. If an unregistered bookkeeper provides these services, they’re breaking the law.

This rule applies to external contractors. If you hire a bookkeeper as a contractor, it’s your responsibility as the business owner to ensure they are a registered BAS agent if you need them to perform BAS services. Conversely, if you have an employee bookkeeper, the TPB’s rules don’t apply, as the business owner is responsible for the accuracy of their work.

It’s a common misconception that all bookkeepers can handle all accounting tasks. Unregistered bookkeepers can only provide very basic services. Asking them to process payroll, for example, is technically illegal, as payroll is considered a BAS service. Let’s take a closer look at the differences.

What’s Considered a Basic Bookkeeping Task?

According to the TPB, an unregistered contractor can only provide basic bookkeeping services. These are generally the day-to-day tasks that help a business maintain its financial records. Examples include:

- Bank reconciliations and data entry into an accounting system.

- Processing payments.

- Record keeping.

- Collating and printing reports, such as draft Profit and Loss statements.

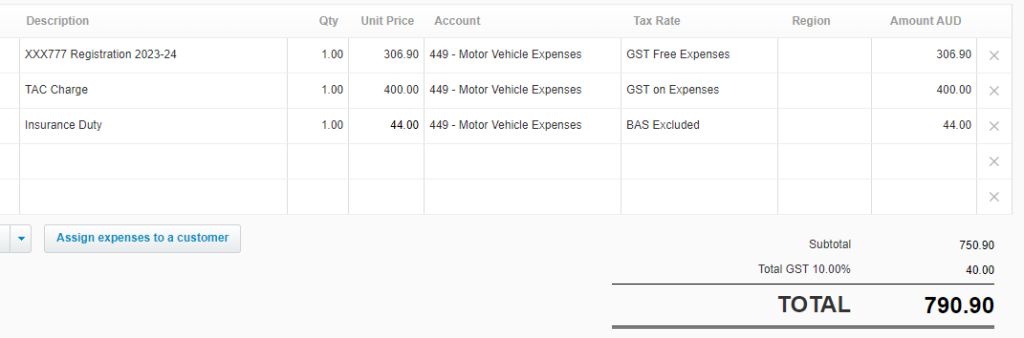

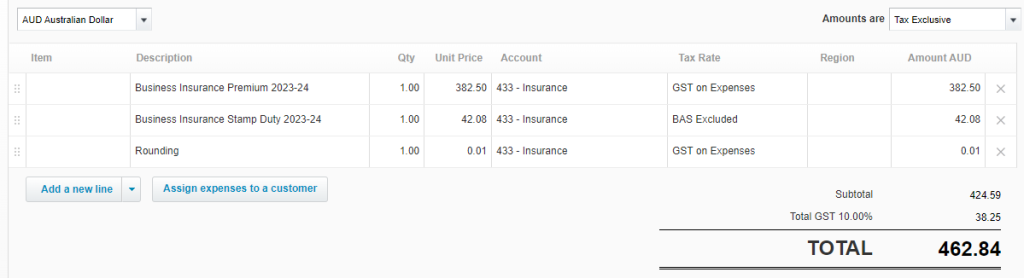

- Coding transactions to accounts based on instructions from the client.

What’s Considered a BAS Service?

A registered BAS agent, on the other hand, can provide a much wider range of services. The TPB has a detailed list, but some of the most common BAS services include:

- Preparing and lodging BAS (Business Activity Statements) and IAS (Instalment Activity Statements).

- Preparing and lodging payroll through Single Touch Payroll (STP).

- Calculating and lodging superannuation guarantee contributions.

You can download the full list from the TPB below for future reference.

Why this Matters for your Business

It’s very common for business owners to hire external bookkeepers, but it’s essential to check their credentials. If a bookkeeper is not a registered BAS agent, they are legally limited to providing only basic bookkeeping tasks. It is illegal for them to charge for and perform BAS services.

Hiring an unregistered bookkeeper to handle BAS services not only puts you and your business at risk but also means the person may not have the necessary qualifications or experience to perform those tasks correctly.

The takeaway is simple: if you only need basic record-keeping, a non-registered bookkeeper may be a good fit. However, if you need someone to handle payroll, BAS, or other more complex services, you must hire a registered BAS agent. Always verify who you’re engaging and what services they are legally allowed to provide.

Key Takeaways

- BAS services and basic bookkeeping tasks differ significantly, with specific legal restrictions around who can perform BAS services.

- Only registered BAS agents can legally provide BAS services, while unregistered bookkeepers are limited to basic tasks.

- Basic bookkeeping tasks include bank reconciliations, data entry, processing payments, and record keeping.

- Common BAS services include preparing and lodging BAS, payroll through STP, and calculating superannuation contributions.

- Business owners must verify a bookkeeper’s registration to avoid legal risks and ensure the correct handling of financial tasks.

Bookkeeping vs BAS Services: Why the Difference Matters Read More »