STP Phase 2: what is it good for?

Have you heard? STP (Single Touch Payroll) is expanding from Phase 1 to, you guessed it, Phase 2. For those who don’t know, STP is a technology that automates the transfer of payroll data from payroll software to government departments, mainly the ATO. STP Phase 2 will see payroll data also being shared with Services Australia, the first in a long list of government departments who will eventually get to see your payroll information (in my opinion). The expansion plan also means that employers will need to update their payroll systems in order to provide much more detail about their payroll at each payroll event (more about that in coming blogs).

This compliance change is happening for better or for worse, so my question is “STP Phase 2, what is it good for?” Absolutely nothing! No, only joking! It turns out that there are quite a few benefits for both employers and employees. This blog will outline those benefits.

Benefits for Employers

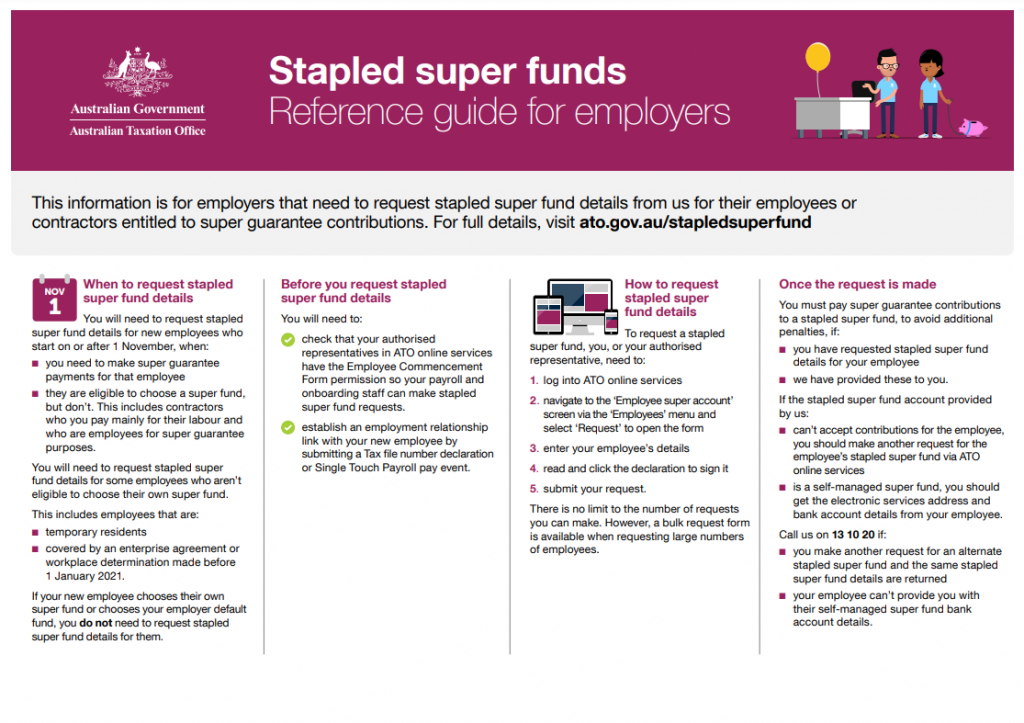

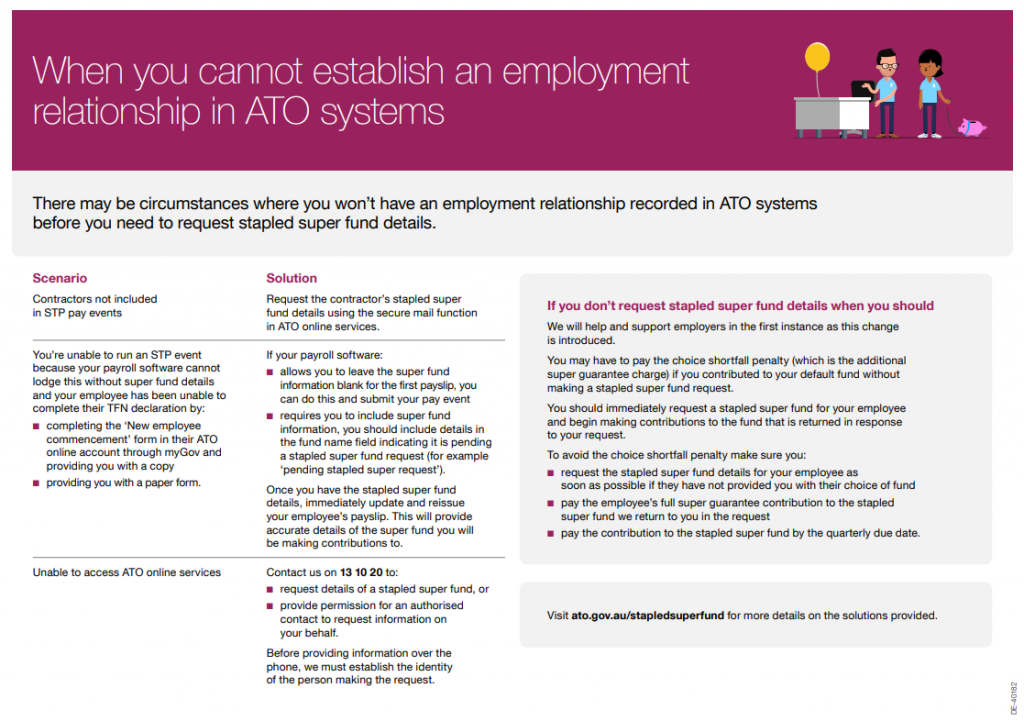

Tax File Number Declarations - although you will need to keep copies of your employees' TFN Declarations as part of your employee records, you will no longer need to send them to the ATO. This is because the information will be sent via each pay event through STP.By nominating an "income type" for employees, you can tell the ATO if you're using concessional reporting for closely held payees or inbound assignees.If you need to make a Lump Sum E payment (back payments more than 12 months old), you won't need to provide a Lump Sum E letter to your employee as it will be included in the STP report.If you change software type or an employee's payroll ID number, this will be reported via the STP report. This will help avoid duplicate income statements appearing in employees' myGov accounts.Data will be shared about some employees with Services Australia (SA). This means that information SA requires from you will be easier to provide e.g. payslips for prior periods.Because the date and reason for employment cessation will be in the STP report, you will no longer need to complete and provide separation certificates to employees.Child support deductions and/or garnishees will be reported via STP reducing the need for you to send separate remittance advice to the Child Support Registrar.

Benefits for Employees

Income statements will become more accurate because the ATO will have better visibility of the types of income an employee receives.If an employee makes an error such as failing to report that he has a study loan debt (resulting in an unwanted tax bill), the ATO will be better placed to rectify the issue sooner rather than later.If employees have dealings with Services Australia (SA), they will see a more streamlined approach to data capture evolve over time, including:

Prefilled details on claim forms and fewer requests for documentation;Spending less time on the phone to SA to confirm details;Receiving SMS or email advice when STP data shows their family income estimate may be too low, they have a new job or their employment details have changed in some way;Ensuring that they are paid the correct amount from SA, andHelping SA understand their financial situation if employees need to repay a debt to SA.

STP Phase 2 requires employers and bookkeepers to make major changes to payroll set up which in the interim, may seem onerous and pretty annoying. However, as can be seen above, there are many benefits for both employers and employees that will come from STP Phase 2 in the long run.

Of course, time will tell if these changes will run smoothly or have unwanted side effects. We will all have to wait and see how things play out. In the meantime, for those wanting further information about STP Phase 2, please visit the ATO STP Phase 2 resources page.

In our next blog in this series, we will review when the main software providers will be ready for STP Phase 2.

STP Phase 2: what is it good for? Read More »