Simple Cash Flow Tool

In this blog, I am going to share a cash flow spreadsheet that I use in my business. This is my very “simple cash flow tool”. It’s not a forecast per se (but could be made into one), rather, it’s a reality check tool for your business, that tells you exactly how much you have to spend, as opposed to how much you think you have to spend!

We’ve all looked at our bank balance when it’s healthy and started having visions of new clothes, holidays and nights out etc. However, as business owners, we also know that we have business (and personal) costs that must be paid for before any of those enticing dollars can find their way into our pockets. Below is a list of those costs included in the spreadsheet. You may have different costs or extra ones – feel free to amend the list to suit your needs.

- General expenses (operating costs)

- Wages, superannuation and PAYG withholding

- GST

- PAYG income tax and/or previous years’ income tax repayments

- Loans and credit card payments

- Previous’ month/quarter BAS

- Your own sundry spending (your drawings or director loan amounts)

How does the spreadsheet/tool work?This tool asks you to review a prior period such as last week, fortnight, month, quarter or year. For the purposes of the tool, we call these periods your “focus periods”. Before you begin using the tool, it is a good idea to choose your focus period. Of course, you can change the period type later as needed, but to begin the process, just choose one period of interest.

In summary, the spreadsheet is split into two sections. The first section takes your opening bank balance at the start of your focus period, adds any income from sales, deducts your operating costs and deducts the required minimum bank balance (that amount you know you need to leave in the bank for running costs). The result provided is the balance available for spending or saving as at the end of the focus period i.e. how much you have at your disposal TODAY. Here is an example of what section one looks like – the cells highlighted in green show your available balance:

You could decide to transfer some funds to savings, pay down debt, buy something special, give employees a bonus, buy new equipment – the choice is yours. While this information about available funds is extremely useful, our tool goes a step further!

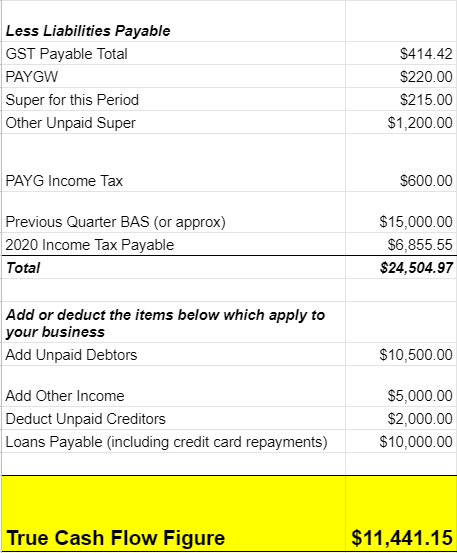

The second section in the spreadsheet takes today’s available balance as above, then adds back any future income and deducts future bill or liability payments.

The final result is called your “true cash flow figure“, and is a more accurate representation of your financial position. Note the difference between the result in section one and that of section two in our example above! The true cash flow figure is less than half of the available funds as at the end of the focus period. This is often the case because section two takes all future cash transactions into account, whereas the figure in section one only looks at the here and now. Don’t get me wrong, knowing your available spending balance as of today is still necessary, however, in order to understand your true cash position, it is important to include all future spending/income. Doing this will ensure that you don’t inadvertently spend dollars that really should be saved for the long term.

Now that you can see your “true cash flow figure” you will be able to make a more informed decision about how much is really available for spending (or saving) today. Of course, if your figure is low or even negative, then perhaps you need to review your situation and work out why this is happening. Whatever the outcome, this tool will provide you with a snapshot of your overall financial position. One important aspect to note is that for this tool to work properly, your accounts need to be up to date. As a minimum, ensure that your bank accounts are reconciled up to the end of your focus period prior to using this tool.

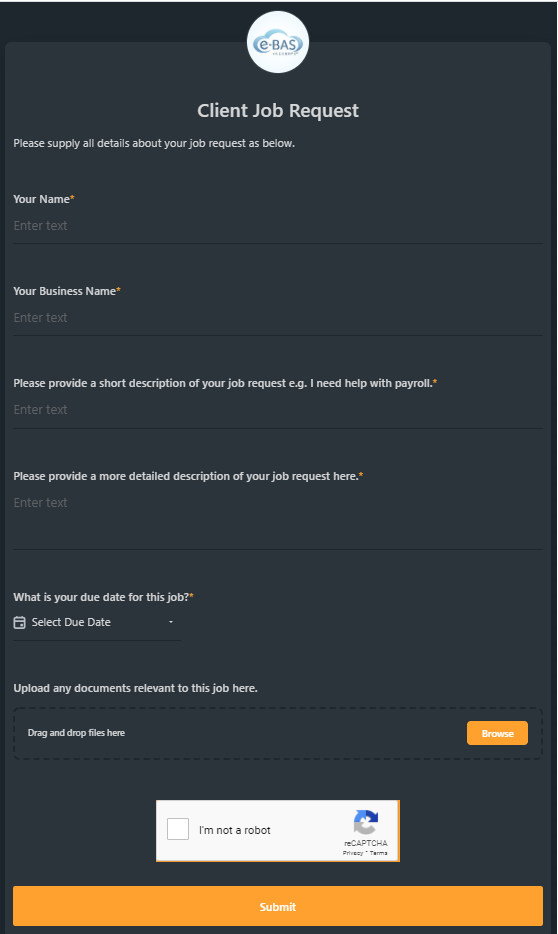

I suggest running this cash flow tool on a regular basis to assist you in controlling and understanding your business finances. If you need assistance to use this tool or would like us to prepare it for you, please get in touch to discuss.

Getting started with the cash flow tool

Open the spreadsheet which is shared below. There are 3 tabs in the spreadsheet. The first tab of the spreadsheet is an example of how the tool works and includes notes and instructions. The second tab is a single-period cash flow to look at one focus period only e.g. one week, one month etc. The third tab is a multi-period tool that allows you to look at several periods at once. Follow the instructions provided in the first tab and then enter the figures as required into either the single or multi-period tab.

I hope you find this spreadsheet tool useful. Let me know if you have any questions about it or have some suggestions about how to improve it, by leaving your comments below.

Simple Cash Flow Tool Read More »