Starting this financial year 2013-14, we’ve decided to go paperless! We’re changing our own bookkeeping processes and also how we keep our clients’ records. In part one of this blog, we’ll tell you about our new paperless bookkeeping system.

Why do we want to go paperless?

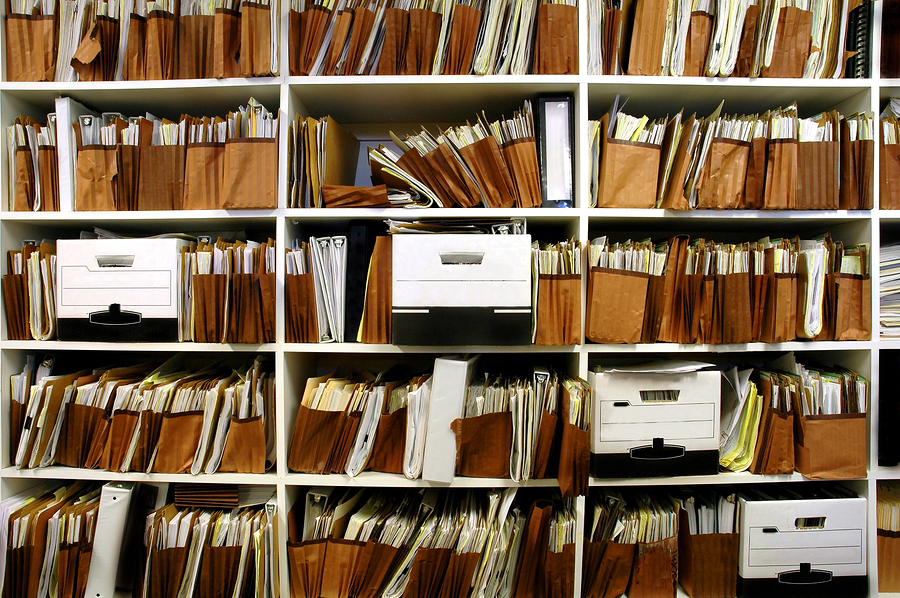

We work from a small home office. When I say it’s small, I mean really small! It currently has 2 full filing cabinets, 3 full large tubs housing client data, and a bookcase brimming over with our own bookkeeping records. Basically, we’ve decided that if we don’t go paperless, our small office will just become a glorified archive room dedicated to storing reams of paper (and probably layers of dust!). As we don’t have the option of confiscating the second room in the house for an office, we decided that we should do something now before the paper really takes over and loss of space becomes a big issue.

There are also other reasons why we want to go paperless:

- Paper deterioration – over time all paper slowly deteriorates and either falls to pieces or becomes completely illegible. Keeping electronic records solves this problem.

- Back ups – our system is backed up every day to an online system called Jungle Disk. Our paperless solution is included in this daily back up. All data is kept safe from possible loss, something that cannot be guaranteed in relation to the paper records. Paper records are at risk from potential threats such as fire, flood, theft etc.

- Security – electronic records are protected by the cloud program used to house them as well as by the backup system we use. Again, such security cannot be assured in relation to our paper records.

- Search function – we use Google Drive to house our records. Google is famous for its search magic! One of the reasons we chose Google Drive is so we can find stuff easily via the search function. The same cannot be said for our paper records. While they are stored alphabetically and via financial year, that’s about as close as it gets to being able to find anything quickly. Finding data still requires pulling out folders and files and spreading them around the office until we find what’s required – not exactly efficient!

- Everything in one place – as I mentioned above, we’ve got stuff stored in filing cabinets, tubs and a bookcase (there might also be folders in the cupboard but I don’t want to look in there!). Our records are all over the shop (office)! It’s tidy but it’s not efficient. By using Google Drive, we can be assured that all data is in one place – much easier to find things!

- Easily share data with others – I dropped off our usual 2 folders containing our financial year-end records to our accountant for the last time a couple of weeks ago. His office is a one hour return trip to my house. I told him that next year I’ll be sharing my electronic tax folder with him and if he needs to meet with me, we can do it via Skype! Those who use Google Apps will know that you can share any folder or file with anyone. This means no more printing out documents and no more paper! If the accountant (or anyone else) wants to see a document, it can easily be shared with him and/or emailed as necessary. Goodbye paper and goodbye unnecessary travel!

Our paperless bookkeeping system

As mentioned already, we have decided to use Google Drive as our online storage facility. We use Google Apps in our business so using Google Drive is logical for us. Google Drive gives us 30Gb of space free before we’re required to purchase extra storage – pretty good!

For our own bookkeeping system, this is how we set up our folders in Google Drive:

Create master folder called "e-BAS Accounts Tax"Create sub folders called "To be paid", "To be entered to Saasu" and "2013-14 FY"Within the "2013-14 FY" folder, create further sub-folders for each expense category required. These categories are taken directly from the chart of accounts used in our accounting system. This will make it easier to find data later.

This is what we do once a week to keep our accounts in order:

- Any paper receipts and/or bills are filed away in a folder (yes paper, I know, I know!) called “to be scanned”.

- On “bookkeeping day” in our office, the items in the “to be scanned” folder are scanned using our new Epsom whiz-bang printer which is wireless and connects to our Google Drive. The data is scanned straight to a special folder in Google Drive. From there, it’s just a matter of allocating the files to either the “to be paid” folder or the “to be entered to Saasu” folder.

- Any bills/docs received via email as PDF’s are saved directly into the Google Drive tax folder and the emails subsequently deleted.

- Any bills needing to be paid and/or entered into Saasu (our chosen cloud accounting software) are dealt with as needed. Once they are processed, they are then filed into the required expense category folder with the “2013-14 FY” folder.

Our experience of going paperless so far…..

Well, in short, it works! The trick is to make sure the above system is done each week. Leaving it until there are loads of docs to scan and/or enter into Saasu would be problematic and painful. The only thing that we found difficult at the start was throwing out original copies of bills once they are scanned. Our inherent need to file away paper caused us some anxiety when it came to actually dispose of the paper bills/receipts – we really did find this difficult weird as this may sound! Now we do it without batting an eyelid – anxiety gone! We are trying to be as “green” as possible and we use old bills for scrap paper (yes scrap paper is still useful!) and pop others into the paper recycling bin. Our next step in the process will be to buy a shredder for shredding sensitive paper documents. My daughter tells me that she can use the shredded waste as a base in her bird’s cage which is good recycling in my book!

In part 2 of this blog, I’ll explain how we have also moved our client records onto a paperless system in Google Drive. I’ll tell you about how our system works and what is involved.

**UPDATE**

Since writing this blog and trialling the paperless system described above (so, 3 months ago), I would like to report that it really does work! Anyone thinking about doing this should absolutely get on board! There is definitely much less paper and much less time spent filing it (or trying to find places to put it). The best part of going paperless for me has been the search functionality. There have been at least 2 instances where I needed to find invoices fast and just by typing a few keywords in the search box in Google Drive, I was able to find the documents within seconds – brilliant! I have also purchased the shredder I spoke of above from Dick Smith – a great addition to the paperless system – it also shreds old credit cards and CDs/DVD’s – very useful!

What would I change?

Well, actually not that much! The only thing I think needs to be changed is the way I’m recording the date on each file. At the moment I save each document as e.g. 27.01.14_name of file_$amount paid. This is okay except that when I look at a long list of documents saved in this way, I cannot easily sight a particular document by date quickly – quite a bit of eye scanning is required. So I’ve decided that I’ll keep on using my current format until the end of the financial year and then after that, I’ll start using this format which should eliminate the above issues e.g. 2014.01.27_name of file_$amount paid. With just one change of how I record the date, I should be able to easily sort and find documents quickly – well more quickly than I can now 🙂 If I think of any other changes I can make to enhance the paperless office experience, I’ll be sure to let you know with further updates on this blog. Bye for now!